Unlocking Value Through Discipline and Insight

The Sower Method: We allow long term

fundamentals and process driven risk management to drive our investment decisions - consistently placing our investor partners in the path of value creation.

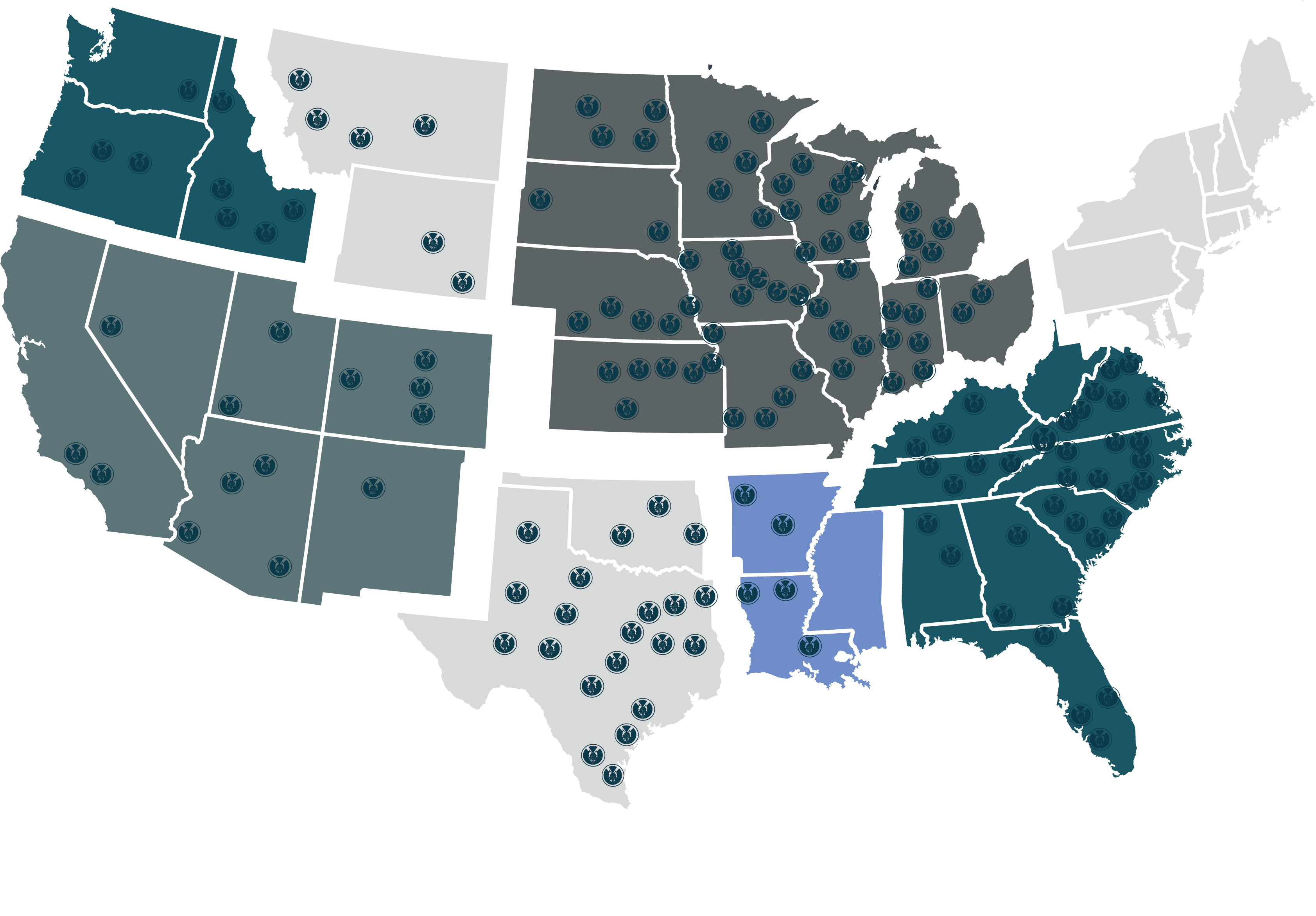

Market Experience

Sower Commercial primarily targets non-coastal markets where the Principals have operational experience.

The markets of significant interest include mostly secondary and tertiary markets that have a positive outlook for a strong and diverse employer base.

These characteristics have been consistent with most investments made to date and have led to predictable outcomes and performance.

Sower Project Styles

BUILD TO SUIT

The build-to-suit model provides for risk protection and predictability, and will be implemented with tenants and locations that align with our operating profile.

The future utility and rent profile of the asset are considered to protect against downside in the event of a tenant rollover. Most importantly, a build-to-suit opportunity provides long-term ownership in very valuable sites.

REVERSE BUILD TO SUIT

Sower has unique relationships with several single-tenant operators that prefer a reverse-build-to-suit model. This model essentially locks in the value at an above market yield and protects the investment from project cost risk.

Most importantly, it provides long-term ownership in very valuable sites that will have outstanding 2nd and 3rd generation prospects.

New construction (multi-tenant)

Construction of new projects in markets that can provide a strong commitment from an ideal tenant mix will be considered. This will include projects that have long-term potential for positive rental growth.

ACQUISITION OF DISTRESSED PROPERTIES

The acquisition of distressed properties will also be considered if there is a tangible opportunity to add significant value. Careful consideration will be made to mitigate development risks when evaluating a redevelopment site’s true potential.

LAND PURCHASE OR ASSEMBLAGE

If opportunities exist to acquire improved or raw ground that can be utilized for an Sower project in the near term, they will be considered. These purchases will only be considered if the acquisition of excess land allows for a value added opportunity through the land holding period.

Understanding The Asset

UNDERSTAND THE MARKET (SHORT AND LONG TERM)

Sower’s goal is to build a portfolio of assets within the funds managed by Sower that will stand the test of time. Having a deep understanding of the market and influencing factors is imperative to the long-term success of the asset. Throughout our market and site selection process, the following key considerations are given to ensure success:

- Employment Trends and Industry Concentrations;

- Demographic patterns & projected 10-20 year changes;

- Stability of Trade Area and likelihood of competition; and

- Municipality Master Planning & Zoning

UNDERSTAND THE ASSET & TENANT

The most important factor driving the success of a real estate asset is the success of the tenant. The Sower team has a unique understanding of this dynamic and takes a very hands-on approach to occupancy success. This starts with a careful analysis of the subject market and tenant demand. Before a project is considered, it is essential to have strong long-term desirability by a wide base of potential tenants. This trait must then be measured throughout the life of the project to ensure the occupancy remains successful and ultimately ensures the successful financial performance of an asset.

COVER THE DOWNSIDE

The primary responsibility of Sower is to protect and defend the assets entrusted while delivering a meaningful return over the life of the fund. A key component of this responsibility is covering the downside risk associated with every transaction. The real estate economy lives in a cycle that can have swings in value and performance. It is our goal to use the following methods to ensure the downside risk is always protected:

- Solid tenants with proven performance;

- Underwrite for averages, not the current market; and

- Use responsible and disciplined leverage that will perform in all environment

BE MINDFUL OF THE FUTURE

While an asset may perform today, the true test of the sound real estate asset is the performance over the long term. It is the desire of Sower to acquire and manage assets that will be strong candidates for 2nd and 3rd generation development and management. With this as a “top of mind” consideration in all potential projects, the future performance is always our focus.

LET'S CONNECT

Talk to Sower Commercial about investing confidently in commercial real estate.