Premier Real Estate investment Partner

Sower Commercial works hand in hand with our partners throughout the US to deliver value to our investors by underwriting, acquiring and strategically managing each asset owned to maximize cashflows and unlock value.

Our Mission is to create value by executing fundamentally sound real estate development, redevelopment or value add projects supported by strong market forces, strong tenant credit and demand, and sound underwriting and downside risk management.

Sower Commercial General Partners: Jared Hollinger, Darren Hicks, Kirk Hanson

Fundamental Expertise

Capital Management

- Capital Sourcing & Allocation

- Risk Management

- Financial Structuring

- Portfolio Optimization

- Exit Strategies

Debt Origination

Sower initiates & manages financing requirements to maximize impact on results while maintaining safety & soundness, including:

- Debt Relationship Management

- Debt Capital Sourcing

- Deal Structuring

- Due Diligence and Documentation

- Risk Assessment and Modeling

Portfolio Management

Sower collaborates with trusted partners to maximize investment results through diligent asset and portfolio management. Key elements include:

- Property Management & Operations

- Strategic Lease Planning

- Financial Impact Modeling

- Capital Expense Planning

- Performance Monitoring

Due Diligence

Sower provides comprehensive investigation and analysis of the real estate transaction to assess the property’s condition, legal status, & financial performance, including:

- Legal and Financial Due Diligence

- Physical and Market Due Diligence

- Environmental Due Diligence

- Risk Assessment

- Documentation and Disclosure

Investor Relations

Sower manages and maintains relationships with investors that foster transparency, communication, and trust between our entities. We take pride in our:

- Communication & Reporting

- Transparency

- Relationship Management

- Compliance

- Marketing and Promotion

Origination

Sower initiates opportunities via strong relationships with owners, brokers & developers while maintaining expertise to underwrite investments. We provide:

- Initial Opportunity Evaluation

- Underwriting and Risk Management

- Acquisition Structuring

- Relationship Management

- Regulatory Compliance

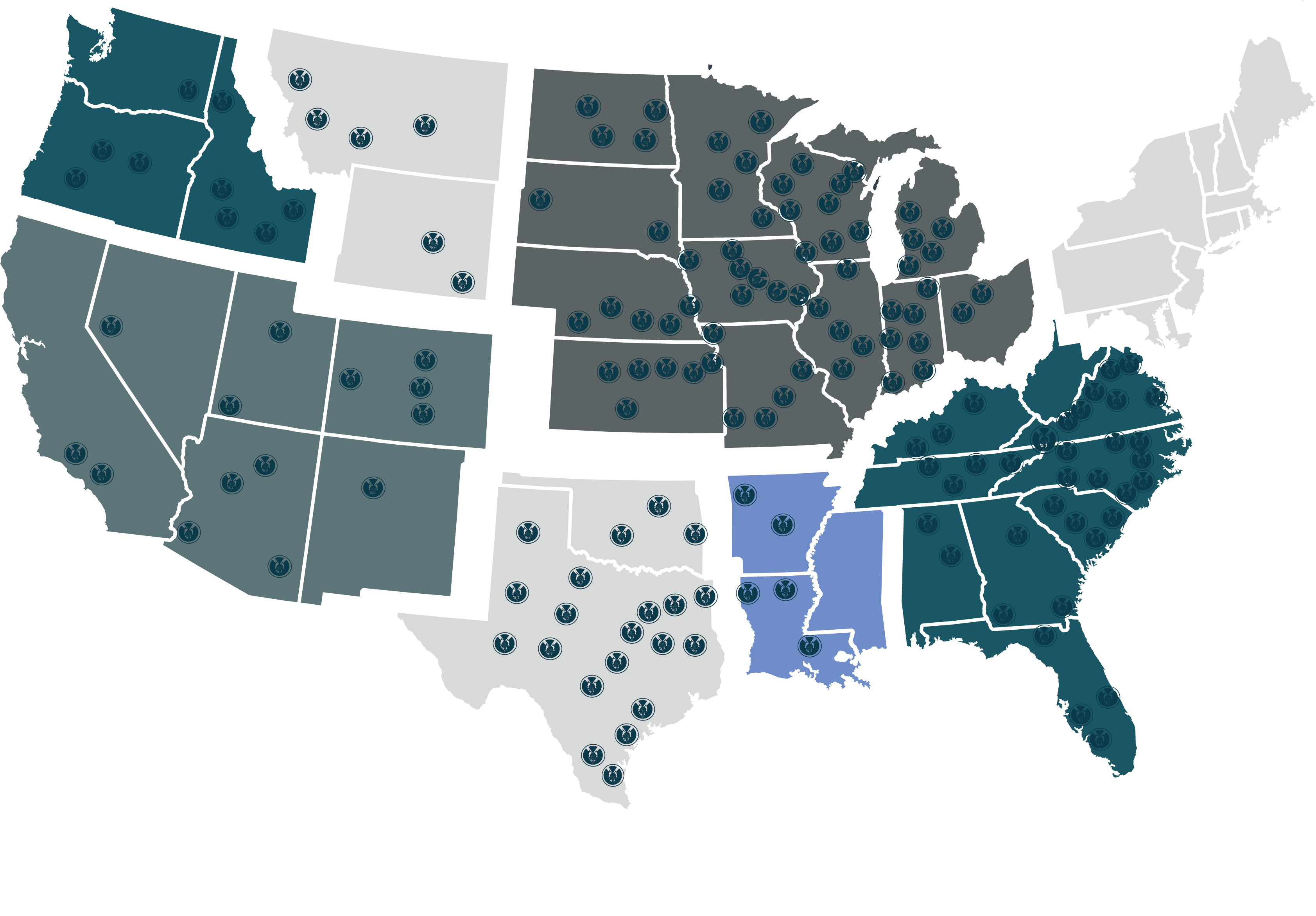

Nationwide Experience

Investment properties in a diverse range of key markets across the United States allow Sower to leverage the unique opportunities and advantages offered by different regions – maximizing investment potential, mitigating risks and enhancing resiliency to market fluctuations.

We maintain flexibility to capitalize on emerging trends and opportunities in dynamic real estate markets.

Our range allows us to be well-positioned to generate strong returns and create value for our investors.

strategic Focus

Value Add

Development

Our development focus is to execute projects that feature irreplaceable locations in prime trade areas creating long term intrinsic value capable of weathering any market cycle.